“If you’ve got a positive repayment history with a few places that you’ve borrowed money from before, whether it be a credit card or a loan, that’s certainly the most important piece.”Ĭan I Still Get an Auto Loan With Bad Credit? So that’s the easy kind of ‘Credit 101’ thing,” he said. “That in itself raises the score, no matter which model you are looking at. No matter which credit bureau someone is dealing with, though, Hunsley said the recipe for improving their credit history is usually straightforward: Seeking positive credit repayment experiences (in other words, repaying outstanding loans) is key. Should You Trade in Your Car, or Sell It Privately?.Leasing vs Financing a Car: What’s the Difference and What’s Best for Me?.Pros and Cons of Buying New vs Used Cars.Buying a Used Plug-In or EV? Here’s What You Need to Know.The other side of it is, I might have a different appetite as BMO than a near-prime auto lender, for example.” “So getting into exacting credit score numbers would probably not be the right thing to do. “Equifax has a credit score, BMO has a credit score, TransUnion has a credit score,” Hunsley explained.

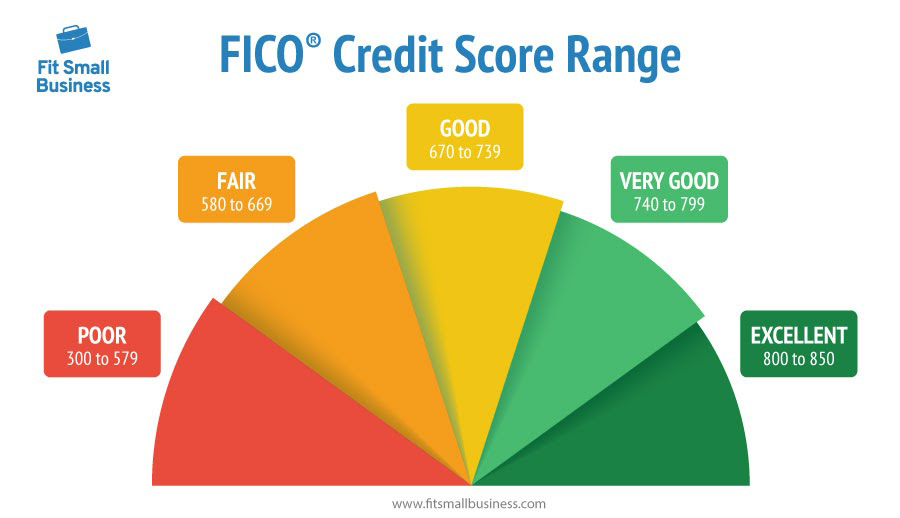

While Borrowell gets its credit profile data from Equifax, which is one of Canada’s largest consumer credit reporting agencies, other credit reporting firms may have different information. How Can I Improve My Credit Score for a Car Loan?Ī framework like the one outlined above should only be used as a rule of thumb, explained the Bank of Montreal’s Vice President of Retail Automotive Finance, Paul Hunsley. Those with below-average credit of 575 to 659 may have a more difficult time getting approved for a loan, whereas those with poor credit will likely have to find a sub-prime lender that specializes in high-risk clients. Individuals with a credit score above 712 may get their loan approved quicker and may receive more favourable conditions. Below Average- credit scores between 575-659īorrowell says most Canadians will be approved for the loan offer they need if they have a credit score between 660 and 712.Excellent – credit scores between 741-900.What is Considered a Good Credit Score in Canada?Īccording to leading Canadian fintech company Borrowell, most Canadian lenders will evaluate an individual’s credit score using the following breakdown: Matters involving money can be stressful, but the good news here is that no matter what an individual’s credit history report looks like, it’s likely that someone will be willing to provide them with an auto loan. This article will explain what is considered a good credit score among most auto lenders, how credit scores influence car loans, and how consumers can secure the car loan they want if they have a less-than-stellar credit score. While there’s no minimum credit score required to take out a loan, consumers will have a much easier time securing a loan with favourable terms and lower interest if they have a strong credit history.

Canadians in the market for a new or used vehicle will very likely have to take out a loan to complete the purchase.

0 kommentar(er)

0 kommentar(er)